The Ministry of Foreign Affairs has put up a travel advisory against non-essential travel to Israel and Palestinian Territories in view of the ongoing conflict.

If you have purchased a Tiq Travel policy...

Before 07 October for travel to Israel and Palestinian Territories and do not wish to travel at this point in time

• You may cancel the trip and file for trip cancellation / trip postponement

Before 07 October for travel to Israel and Palestinian Territories and are already in Israel and Palestinian Territories at this point in time

• You will still be covered for benefits like Travel Delay, Baggage Delay, Flight Diversion, Trip Curtailment

After 07 October for travel to Israel and Palestinian Territories

• There will be no coverage as the ongoing conflict is a known event

Travel Advisory

Please note that travel insurance policies purchased on or after 24 November 2025 do not cover any losses related to the floods in Thailand, as it is considered a known event.

We encourage travellers to stay informed and review their travel plans. For details on coverage, please refer to your policy wording. Claims are subject to the policy’s terms and conditions.

Please note that travel insurance policies purchased on or after 18 June 2025, 8.50pm do not cover any losses related to the Israel-Iran conflict, as it is considered a known event. This applies to travel to Israel, Iran, Jordan, Lebanon, Egypt, Bahrain, Kuwait, Oman, Palestine, Qatar, Saudi Arabia, United Arab Emirates and Yemen.

We encourage travellers to stay informed and review their travel plans. For details on coverage, please refer to your policy wording – claims are subject to policy terms and conditions.

Please note that travel insurance policies purchased on or after 7 October 2023 do not cover any losses related to the Israel-Hamas conflict, as it is considered a known event. This applies to travel to Israel and the Palestinian Territories.

We encourage travellers to stay informed and review their travel plans. For details on coverage, please refer to your policy wording – claims are subject to policy terms and conditions.

Your Best Travel Partner

- Most Popular Travel Insurance Company

- Best Travel Insurance (Single Trip)

- Best Travel Claims Experience

Why Tiq Travel Insurance?

| Comprehensive COVID-19 add-on, protecting you before, during and after your trip |

| Covers all forms of transportation |

| Coverage for pre-existing medical conditions [Learn More] |

More Value-Added Services Specially For You

| Full refund if you need to cancel your travel policy |

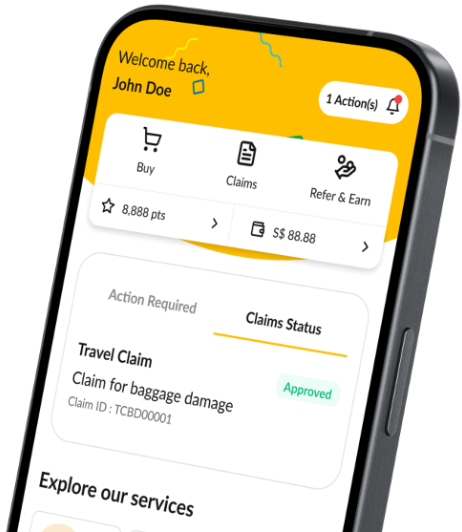

| Get paid upon a 3-hour flight delay, even without submitting a claim |

| 24-hour worldwide emergency travel support |

| Flight check-in reminder |

| Baggage belt collection details |

What are the COVID-19 add-on coverages? NEW

We know that you are eager to travel, and we want to ensure that you are well covered against COVID-19.

With our COVID-19 add-on, power up your travel insurance coverage as we cover you comprehensively before you start your overseas trip, during and after you come back to Singapore.

Before your trip

Covers up to $5,000 on non-refundable costs for cancelling or postponing your trip 14 days before your departure date.

During your trip

Covers up to $500,000 for emergency medical evacuation & repatriation, medical expenses, quarantine allowance and additional cost incurred for disruptions to your trip.

After your trip

Get a lump sum payout if you are hospitalized in Singapore.Benefits are provided in the event if you are diagnosed with COVID-19

Travel delay?

No sweat with automated flight delay benefit!

| 1 | ||

|

Input your flight details when purchasing |

Input your flight details when purchasing

| 2 | ||

|

Get paid upon a 3-hour flight delay, even without a submitting claim |

Get paid upon a 3-hour flight delay, even without a submitting claim

| 3 | ||

|

Receive payout in your eWallet Encash via PayNow |

Receive payout in your eWallet and encash via PayNow

Watch this to learn more!

What are Pre-Existing Medical Conditions?

If you have a medical illness or injury before your trip, it may be considered as a pre-existing medical condition. Please note that most travel insurers do not cover claims resulting from pre-existing medical conditions while you're overseas. Thankfully, we do.

Example of pre-existing medical conditions

All types of pre-existing medical conditions from eczema to asthma or heart conditions are covered as long as your illness is stable and under control. For more information on the coverage, please refer to Policy Wording. |

|

|

| Diabetes | Stroke | Asthma |

|

|

|

| Sleep Apnea | Cancer | Epilepsy |

| PLAN HIGHLIGHT | ENTRY | SAVVY | LUXURY |

|---|---|---|---|

| Medical Expenses Incurred Overseas |

$200,000

Pre-ex: $75,000 |

$500,000

Pre-ex: $125,000 |

$1,000,000

Pre-ex: $150,000 |

| Medical Expenses in Singapore | NA | $7,500 | $10,000 |

| Trip Cancellation and Loss of Deposit | $5,000 | $5,000 | $10,000 |

| Baggage Delay | $200 ($100/6 hrs) | $200 ($100/6 hrs) | $200 ($100/6 hrs) |

| Travel Delay | $300 ($50/3 hrs) | $300 ($50/3 hrs) | $500 ($50/3 hrs) |

| Personal Accident (Accidental Death and Permanent Disablement) | |||

| Adult aged below 70 years old | $150,000 | $300,000 | $500,000 |

| Adult aged 70 years old and above | $30,000 | $40,000 | $50,000 |

| Child | $50,000 | $100,000 | $200,000 |

| Medical Expenses Incurred Overseas | |||

| Adult aged below 70 years old |

$200,000 Pre-ex: $75,000 |

$500,000 Pre-ex: $125,000 |

$1,000,000 Pre-ex: $150,000 |

| Adult aged 70 years old and above |

$30,000 Pre-ex: $20,000 |

$50,000 Pre-ex: $40,000 |

$75,000 Pre-ex: $50,000 |

| Child |

$75,000 Pre-ex: $50,000 |

$150,000 Pre-ex: $75,000 |

$250,000 Pre-ex: $100,000 |

| Medical Expenses Incurred in Singapore | |||

| Adult aged below 70 years old | Not Covered | $7,500 | $10,000 |

| Adult aged 70 years old and above | Not Covered | $1,000 | $3,000 |

| Child | Not Covered | $2,500 | $5,000 |

| Overseas Hospital Income |

$5,000 ($200/24 hrs) |

$10,000 ($200/24 hrs) |

$20,000 ($200/24 hrs) |

| Hospital Allowance in Singapore | $500 ($50/24 hrs) | $1,000 ($100/24 hrs) | $1,500 ($100/24 hrs) |

| Hospital Visitation | Not Covered | $2,500 | $5,000 |

| Compassionate Visit | Not Covered | $5,000 | $7,500 |

| Child(ren) Guardian | Not Covered | $2,500 | $5,000 |

| Emergency Telephone Charges | $100 | $200 | $400 |

| Emergency Medical Evacuation |

Combined limit up to $1,000,000 Pre-ex: Combined limit up to $150,000 |

Combined limit up to $1,500,000 Pre-ex: Combined limit up to $200,000 |

Combined limit up to $1,800,000 Pre-ex: Combined limit up to $250,000 |

| Repatriation Of Mortal Remains to Singapore |

| Trip Cancellation and Loss of Deposit | $5,000 | $5,000 | $10,000 |

| Bankruptcy of Travel Agent | $1,000 | $1,000 | $3,000 |

| Travel Curtailment (including Hijacking) | $3,000 | $3,000 | $5,000 |

| Personal Effects | $2,000 | $2,000 | $3,000 |

| Sub-limit for 1 laptop: $1,000 | Sub-limit for 1 laptop: $1,000 | Sub-limit for 1 laptop: $1,000 | |

| Sub-limit for 1 mobile: $250 | Sub-limit for 1 mobile: $250 | Sub-limit for 1 mobile: $250 | |

| Sub-limit for all other items (per item): $250 | Sub-limit for all other items (per item): $250 | Sub-limit for all other items (per item): $250 | |

| Baggage Delay | $200 ($100/6 hrs) | $200 ($100/6 hrs) | $200 ($100/6 hrs) |

| Loss of Travel Documents (including money) | Personal Money; $100 | Personal Money; $300 | Personal Money; $500 |

| Personal Documents; $150 |

Personal Documents; $250 |

Personal Documents; $500 |

|

| Travel Delay | $300 ($50/3 hrs) | $300 ($50/3 hrs) | $500 ($50/3 hrs) |

| Flight Diversion |

$300 ($100/6 hrs overseas) |

$300 ($100/6 hrs overseas) |

$500 ($100/6 hrs overseas) |

| Flight Overbooking | $100 | $100 | $100 |

| Travel Misconnection | $200 ($100/6 hrs) | $200 ($100/6 hrs) | $200 ($100/6 hrs) |

| Travel Postponement | $500 | $500 | $1,000 |

| Personal Liability | $250,000 | $500,000 | $750,000 |

| Hijacking/Kidnapping and Hostage | $1,000 | $1,000 | $3,000 |

| Automatic Extension of Cover | Up to 7 days | Up to 14 days | Up to 14 days |

| Act of Terrorism Cover | |||

| Adult aged below 70 years old | $100,000 | $200,000 | $300,000 |

| Adult aged 70 years old and above | $30,000 | $40,000 | $50,000 |

| Child | $50,000 | $75,000 | $100,000 |

| Home Content Cover | Not Covered | $5,000 | $10,000 |

| Child Education Cover |

$3,000/child (up to $15,000) |

$3,000/child (up to $15,000) |

$3,000/child (up to $15,000) |

| Rental Car Excess Cover | $300 | $500 | $1,000 |

| Pet Hotel Cover |

$1,000 ($50 for every 6 hrs) |

$1,000 ($50 for every 6 hrs) |

$1,000 ($50 for every 6 hrs) |

| Sport Equipment Protector | $500 | $2,000 | $4,000 |

Don’t worry, we’ll wait for you!

Disclaimer: We will not be held responsible if our reminder doesn’t reach you and you choose to cancel your policy with your existing insurer.

Submit Failed.

Thank you for your submission.

Insured but still looking?

Let us know when your policy ends and we’ll send you a reminder to switch to Tiq by Etiqa Insurance.

Set. Relax. No Regrets!

Don’t worry, we’ll wait for you!

Disclaimer: We will not be held responsible if our reminder doesn’t reach you and you choose to cancel your policy with your existing insurer.

Submit Failed.

Thank you for your submission.

Have questions? We’re here to help

No question is too small—let us know how we can assist you.

Our operating hours are: Monday to Friday, 9.00am to 5.30pm (excluding public holidays)

Please enter your name

Please select an option

Please enter a valid email address

Please enter your mobile number

Please enter a date

Frequently Asked Questions

No, your period of insurance must include your entire trip from the date of departure from Singapore to the date of arrival in Singapore.

Yes. You can mix and match the plans for Married Couple and Group Plans for single trips only, provided the trip does not exceed 30 days.

Information You Might Find Useful

See What Our Customers Say

Important notes:

This policy is underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg). Information is accurate as at 2 September 2024.

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.