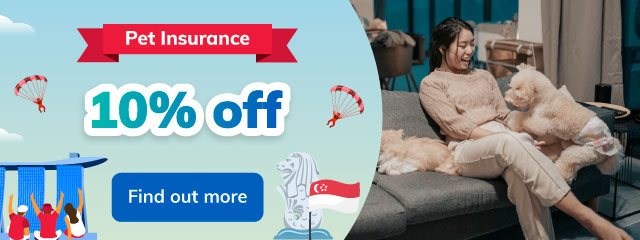

Secure moments with comprehensive Pet Insurance

Stay worry-free. Let our Pet Insurance be your safety net for their care!

Secure moments with comprehensive Pet Insurance

Stay worry-free. Let our Pet Insurance be your safety net for their care!

As per AVS licensing requirements, all dogs must be licensed and registered in Singapore. With effect 1 September 2024, all cat owners must apply for a cat license online via the Pet Animal Licensing System (PALS) and ensure that their pet cat(s) is registered in Singapore. Find out more here.

Coverage Highlights

We believe that providing the best care for your dogs and cats should never be a financial burden. Make a proactive choice to safeguard their health and wellbeing.

Some situations where we cover:

Vomiting, Diarrhoea, Ear Infections, Cancer, Diabetes and more

Surgical

Up to $15,000 coverage for diagnostic tests, vet fees, operating theatre fees,

pet boarding expenses, post-surgical treatment

Non-Surgical

Up to $3,500 coverage for outpatient expenses such as vet fees, prescribed

drugs, dressings

Example of a Claim Scenario based on Plan Pawfect

Initial payment you pay

Total bill from Vet

(Deductible)

Reimbursement Claim

(80%)

Co-Insurance (20%)

Reimbursement amount shown after $200 initial payment you paid.For pet before age 4, there will

be a 20% Co-Insurance.

What’s covered?

Hit by car, Animal attack and Fractured bones

Up to $3,500 coverage for outpatient expenses such as vet fees

Example of a Claim Scenario based on Plan Pawfect

Initial payment you pay

Total bill from Vet

(Deductible)

Reimbursement Claim

(80%)

Co-Insurance (20%)

Reimbursement amount shown after $200 initial payment you paid.For pet before age 4, there will

be a 20% Co-Insurance.

What’s covered?

Legally responsible to pay compensation in respect of Accidental Bodily Injury or Accidental loss to

property caused by your pet

Up to $500,000 for legal cost and expenses

What’s covered?

Expenses due to Euthanasia recommended by Veterinarian if pet dies or suffers accidental bodily injury or

sickness

Up to $500 for costs of cremation, funeral service and/or handling expenses charged by the Veterinarian or funeral service

What’s covered?

Complimentary Congenital and Hereditary Cover is added to your policy if you upload your pet’s Clinical Examination Form that is completed and signed off by a Singapore registered Veterinary Centre within thirty (30) days from the purchase date. You may download the Pet Insurance Clinical Examination Form here and bring it along to your vet for the examination.

- Hip and elbow dysplasia;

- Luxating patella;

- Glaucoma;

- Cherry eye;

- Intervertebral disc disease (IVDD); and/or

- Conditions requiring femoral head and neck excision.

Some situations where we cover:

Vomiting, Diarrhoea, Ear Infections, Cancer, Diabetes and moreSurgical

Non-Surgical

Example of a Claim Scenario based on Plan Pawfect

Initial payment you pay

Total bill from Vet

(Deductible)

Reimbursement Claim (80%)

Co-Insurance (20%)

What's covered?

Hit by car, Animal attack and Fractured bonesSurgical

Example of a Claim Scenario based on Plan Pawfect

Initial payment you pay

Total bill from Vet

(Deductible)

Reimbursement Claim (80%)

Co-Insurance (20%)

What's covered?

Legally responsible to pay compensation in respect of Accidental Bodily Injury or Accidental loss to propery caused by your pet

What's covered?

Expenses due to Euthanasia recommended by Veterinarian if pet dies or suffers accidental bodily injury or sickness

What's covered?

Complimentary Congenital and Hereditary Cover is added to your policy if you upload your pet’s Clinical Examination Form that is completed and signed off by a Singapore registered Veterinary Centre within thirty (30) days from the purchase date. You may download the Pet Insurance Clinical Examination Form here and bring it along to your vet for the examination.

- Hip and elbow dysplasia;

- Luxating patella;

- Glaucoma;

- Cherry eye;

- Intervertebral disc disease (IVDD); and/or

- Conditions requiring femoral head and neck excision

Plan Highlights

|

||||

|---|---|---|---|---|

| What is Covered |

Pawsome |

Pawmazing |

Pawtastic |

Pawfect |

| Lifetime Limit for Section 1 to 3 per Pet | $10,000 | $20,000 | $30,000 | $45,000 |

| Surgical Illness Cover* | $2,000 | $5,000 | $10,000 | $15,000 |

| Non-Surgical Illness Cover* | $500 | $1,000 | $2,500 | $3,500 |

| Accidental Injury* | $500 | $1,000 | $2,500 | $3,500 |

| Funeral Expenses | N/A | $250 | $350 | $500 |

| Third Party Liability | N/A | $100,000 | $250,000 | $500,000 |

| Co-Insurance |

20% - Pets enrolled before age 4 30% - Pets enrolled before age 9 |

|||

*Deductible of $200 and Co-insurance applies

A waiting period applies from the policy’s effective date: 3 months for illness (Surgical and Non-Surgical) and 1 month for Accidental Injury coverage.

|

|||

|---|---|---|---|

|

Pawsome |

Pawmazing |

Pawtastic |

Pawfect |

| Lifetime Limit for Section 1 to 3 per Pet | |||

| $10,000 | $20,000 | $30,000 | $45,000 |

| Surgical Illness Cover* | |||

| $2,000 | $5,000 | $10,000 | $15,000 |

| Non-Surgical Illness Cover* | |||

| $500 | $1,000 | $2,500 | $3,500 |

| Accidental Injury* | |||

| $500 | $1,000 | $2,500 | $3,500 |

| Funeral Expenses | |||

| N/A | $250 | $350 | $500 |

| Third Party Liability | |||

| N/A | $100,000 | $250,000 | $500,000 |

| Co-Insurance | |||

|

20% - Pets enrolled before age 4 30% - Pets enrolled before age 9 |

|||

*Deductible of $200 and Co-insurance applies

A waiting period applies from the policy’s effective date: 3 months for illness (Surgical and Non-Surgical) and 1 month for Accidental Injury coverage.

How does No-Claim Discount work?

✓ Up to 20% no-claims discount

If there is no claim during

your period of insurance

Year 2

-5% off

Year 3

-10% off

Year 4&5

-15% off

Year 6 >

-20% off

How Multi-Pet Discount Works?

✓ Up to 10% multi-pet discount

For each additional pet in a single transaction,

the discount below will be applied individually.

How does No-Claim Discount work?

✓ Up to 20% no-claims discount

If there is no claim during

your period of insurance

Year 2

-5% off

Year 3

-10% off

Year 4&5

-15% off

Year 6 >

-20% off

How Multi-Pet Discount Works?

✓ Up to 10% multi-pet discount

For each additional pet in a single transaction,

the discount below will be applied individually.

What is Special About Us?

| Plans Features |  Pet Insurance |

Insurance A | Insurance B | Insurance C |

|---|---|---|---|---|

| Entry Age | 8 weeks onwards | 16 weeks onwards | 8 weeks onwards | 12 weeks onwards |

| Medical expenses due to Illness (Surgical) |

Up to $15,000 -up to 30% co-insurance -$200 deductible |

Up to $22,000 -up to 40% co-insurance -$200 deductible |

Up to $10,000 -up to 30% co-insurance |

Optional add-on $1,500 -$100 deductible |

| Medical expenses due to Accident |

$3,500 -up to 30% co-insurance -$50 deductible |

$2,500 -$250 deductible |

$3,000 -$50 deductible |

$1,500 -$100 deductible |

| Post-surgical treatment benefit | ||||

| Final expenses benefit | Up to $500 | Up to $2,500 | Up to $300 for accidental death | |

| Congenital & Hereditary Conditions Cover | ||||

| Loss due to theft | Up to $1,250 | Up to $300 for accidental death | ||

| No-Claim Discount | Up to 15% | Up to 15% | ||

Pet Insurance Pet Insurance |

Insurance A | Insurance B | Insurance C |

|---|---|---|---|

| Entry Age | |||

| 8 weeks onwards | 16 weeks onwards | 8 weeks onwards | 12 weeks onwards |

| Medical expenses due to Illness (Surgical) | |||

|

Up to $15,000 -up to 30% co-insurance -$200 deductible |

Up to $10,000 -up to 40% co-insurance -$250 deductible |

Up to $10,000 -up to 30% co-insurance |

Optional add-on $1,500 -$100 deductible |

| Medical expenses due to Accident | |||

|

$3,500 -up to 30% co-insurance -$50 deductible |

Combined Limit with Medical expenses due to Illness (Surgical) |

$3,000 -$50 deductible |

$1,500 -$100 deductible |

| Post-surgical treatment benefit | |||

| Final expenses benefit | |||

| Up to $500 | Up to $250 | Up to $300 for accidental death | |

| Congenital & Hereditary Conditions Cover | |||

| Loss due to theft | |||

| Up to $1,250 | Up to $300 for accidental death | ||

| No-Claim Discount | |||

| Up to 20% | Up to 15% | Up to 15% | |

This comparison does not include information on all similar products. Etiqa Insurance Pte. Ltd does not guarantee that all aspects of the products have been illustrated. The comparison provides a summary of benefits for general comparison purpose from publicly available information. This information is accurate as of 10 June 2025.

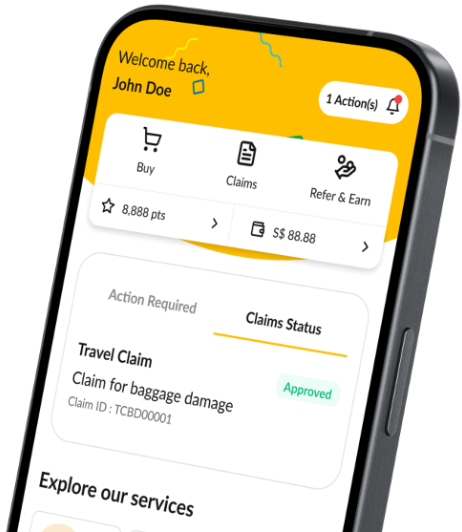

What To Expect After Buying Pet Insurance?

- You’ll receive a confirmation email with your policy schedule and policy wording.

- For easy policy access and management, download our Etiqa+ SG app.

- Endorsements, claims, and live help are all available to you on our Etiqa+ SG app as well.

Have questions? We’re here to help

No question is too small—let us know how we can assist you.

Our operating hours are: Monday to Friday, 9.00am to 5.30pm (excluding public holidays)

Please enter your name

Please select an option

Please enter a valid email address

Please enter your mobile number

Please enter a date

Frequently Asked Questions

Your Pet is licensed and You are the registered owner of Your Pet in Singapore;

- Your Pet is residing with You in Singapore;

- You must be a Singapore Citizen, or a permanent resident of Singapore, or a foreigner with valid Work Permit or Employment Pass or Dependant’s Pass or Long-Term Visit Pass;

- Your Pet is micro-chipped and has completed the required vaccination(s);

- Your Pet is at least eight (8) weeks old and below nine (9) years old at the start date of the Period of Insurance;

- Your Pet is not a working pet (such as guide dog, hunting dog or attack dog) or racing pet; and

- Your Pet is not used for breeding purposes.

We understand that some pets carry genetic conditions due to their breed. That is why we provide complimentary Congenital and Hereditary coverage for the following conditions, subject to a 12-month waiting period and provided it is not a pre-existing condition according to the Clinical Examination Form submitted within thirty (30) days from the purchase date of this policy.

- Hip and elbow dysplasia;

- Luxating patella;

- Glaucoma;

- Cherry eye;

- Intervertebral disc disease (IVDD); and/or

- Conditions requiring femoral head and neck excision.

In order to receive this complimentary cover, you are required to prove that your pet is clinically examined by a Singapore Registered Veterinarian within thirty (30) days from the purchase date. You will need to submit our Pet Insurance Clinical Examination form within thirty (30) days from the purchase date in order to qualify for the complimentary coverage. The complimentary coverage is automatically extended upon the completion and submission of your pet’s clinical examination form and is not applicable for add-on after the purchase or during the renewal of the Pet Insurance policy.

If Your Pet is below six (6) months old and you choose to delay the blood test, you may submit the Clinical Examination Form within 30 days after Your Pet turns six (6) months old, but before Your Pet reaches seven (7) months old, to qualify for complimentary coverage for Congenital and Hereditary Conditions. The Clinical Examination Form can be submitted through our customer portal, TiqConnect after the purchase.

Download the Pet Insurance Clinical Examination Form and bring it along to your vet for the examination.

No Claim Discount is a benefit that you get to enjoy as a policyholder during your renewal, if your pet has no claims during period of insurance.

| Period of Insurance | NCD Applicable |

| First Renewal Year | 5% |

| Second Renewal Year | 10% |

| Third and Fourth Renewal Year | 15% |

| Fifth Renewal Year and More | 20% |

There is a Waiting Period from the Effective Date of Insurance before the Benefit(s) can be payable.

- Section 1: Surgical Illness Cover, Non-Surgical Illness Cover – 3 months

- Section 2: Non-Surgical Illness Cover – 3 months

- Section 3: Accidental Injury – 1 month

Please refer to policy wording for full details.

Information You Might Find Useful

See What Our Customers Say

Featured Articles

The Ultimate Guide to Choosing the Right Pet Insurance

Important notes:

This Policy is underwritten by Etiqa Insurance. Pte. Ltd. This content is for reference only and is not a contract of insurance. Full Details of the policy terms and conditions can be found in the policy wording. Information is accurate as at 16 August 2024

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.