Amidst our busy lives, it is easy to overlook important matters such as buying or renewing the home insurance. Don’t forget to check and make sure that you have proper home protection!

More than just a shelter and four walls, a house is usually one of our most valued assets. Yet, it is easy to overlook essential home protection over daily needs. Despite our best efforts to manage our household and take care of our home contents, some things are just unavoidable.

According to SCDF’s annual report, there were approximately 1,800 home fire incidents reported in 2024, marking a slight increase from the previous year. Leading causes include electrical fires, which accounted for around 40% of the cases, as well as unattended cooking, which was responsible for about 35% of incidents. While fire insurance is mandatory for public housing, there’s a limitation to the coverage. Regardless of your home property type, it is essential to get comprehensive home insurance with suitable coverage.

First, let’s be clear on this: What is home insurance?

Many homeowners think that home insurance is a complicated subject. The truth is, for a relatively small amount, you can obtain insurance coverage that could save you tens of thousands of dollars in the event of a fire or some other type of accident. The purpose of a home insurance is to protect your home, your family and you in the event of home disasters.

Before you fall prey to the “optimism bias” and think that “it won’t happen to me”, you should be aware that even if you are super careful at home, you are not entirely safe because a fire, water leak or pest infestation from your neighbours could very well affect you!

Remember the Katong terrace house fire which spread to two neighbouring units? Even though the fire was largely contained to the affected house, two adjacent houses also sustained burn damages, demonstrating that fires can spread quickly and cause harm even when individuals are not directly at fault. These situations remind us that fire safety extends beyond our control and that we must always remain vigilant, prepared, and insured against unforeseen incidents

Putting costs in perspective

Everyone thinks of their home as a safe haven but accidents do occur. In 2019, the homeowner of a two-storey Tampines maisonette flat spent around S$90,000 out-of-pocket to restore and renovate their home that was damaged by fire. They didn’t have home insurance then. For two months after the home fire incident, the family of four had to stay with a relative.

In 2020, another homeowner found his 5-room flat at Clementi to be so badly burnt that it incurred a cost of S$80,000 to restore and renovate. Thankfully, the full amount was covered by insurance.

| Cost of home insurance | Cost to rebuild a home | Compensation cost |

| from S$28/year for Tiq Home Insurance |

Up to S$150,000 for a 4- to 5-room HDB flat |

Up to S$500,000 if a fire in your home destroys your neighbour’s home |

The above costs and compensation to rebuild a home in Singapore were tabulated several years ago. In the current climate of global economic downturn and rising inflation, the cost to rebuild a home is bound to be higher. Hence, it makes great sense to get comprehensive home insurance.

Is home insurance necessary in Singapore?

Aside from the fact that a house is possibly the largest asset that most people will ever own, looking at the abovementioned costs would lead one to understand the necessity of having adequate insurance coverage. Most lenders require a mortgagee to carry replacement-value house insurance at all times.

For example, if you take a HDB loan for your flat, it is mandatory for you to get HDB Fire Insurance. This policy will take care of rebuilding the structure of your house in case it is damaged by fire. But it is only a basic cover and does not insure your home contents.

Your furniture, the amount that you have incurred on renovation, and your personal belongings are not covered. On the other hand, a comprehensive home insurance policy covers your building, home contents and furniture.

Choosing the right home insurance for you

There are various options of home insurance in Singapore, and with insurers providing similar products and services, it can be tough to make a choice. Nevertheless, no two snowflakes are alike. Here’s a simple guide to help you gain better understanding on how to choose a suitable home insurance. Read on!

1. Know your needs

“How would I know what I need if I’m a new homeowner?” That’s a valid point. If you are a first-time homeowner, you may not know which household concerns would be most relevant to you. Is basic fire insurance sufficient or would you need to get comprehensive home insurance that even covers emergency home repair services?

This calls for some research and self-evaluation. Learning from others’ experiences such as relatives, friends, or helpful articles (like the one you’re currently reading) and online discussions on forums can point you in the right direction.

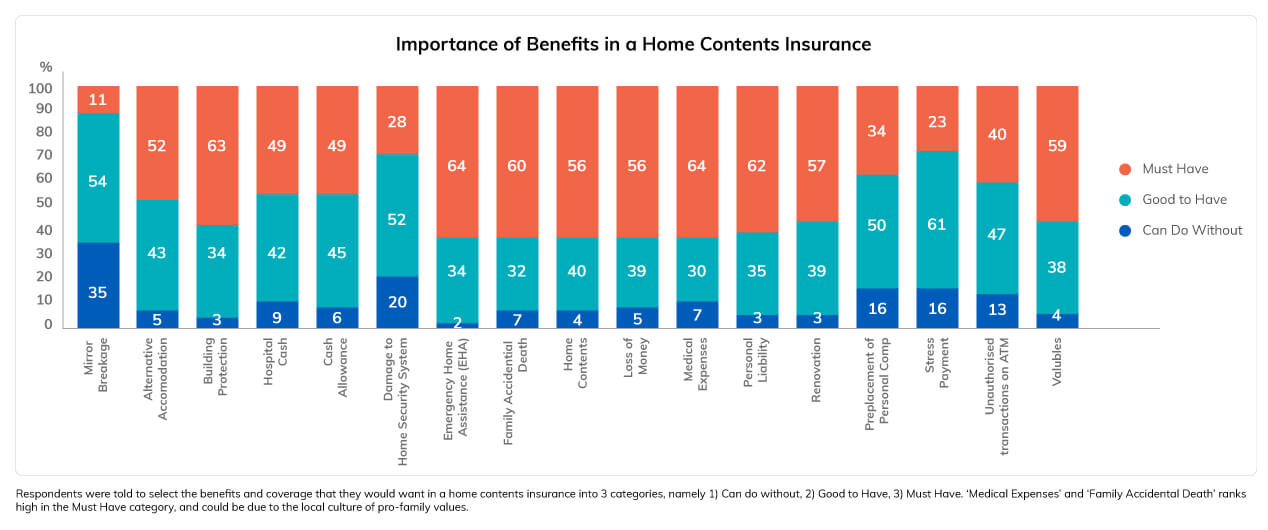

Prior to the launch of Tiq Home Insurance, we did an extensive consumer study^ on common household concerns, so as to create a product based on what people really need. Through our study, we found the top three benefits essential to homeowners to be: Building Protection, Emergency Home Assistance (EHA), and Renovation.

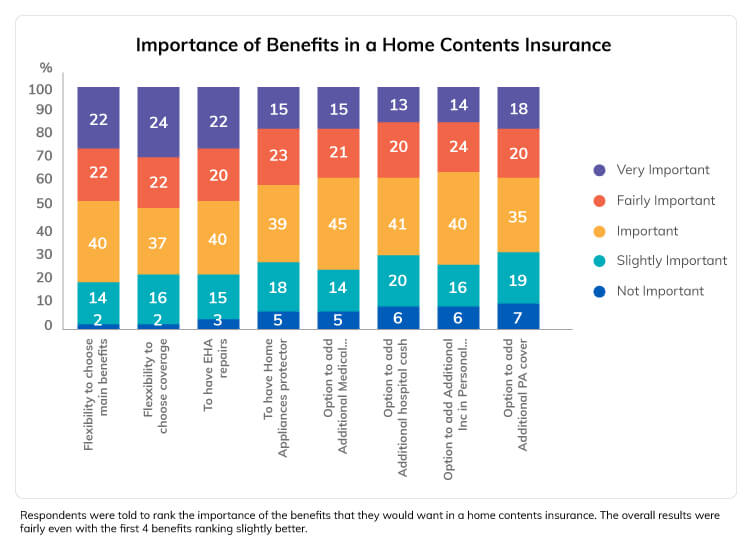

Respondents also indicated the following benefits to be a ‘Must Have’ in a home contents insurance: Flexibility to Choose Main Benefits, Flexibility to Choose Coverage, and EHA. A flexible home protection plan such as Tiq Home Insurance by Etiqa provides these benefits.

A recent review in March 2022 by our customer re-validated these findings. Shan purchased Tiq Home Insurance in addition to her HDB fire insurance. The flexibility of our plan allows her to opt for coverage on home content and renovation only so that she doesn’t need to pay extra for fire protection coverage that she already has.

^2018 Consumer Study on Household Concerns; conducted with 176 respondents living in Singapore by Etiqa Insurance.

If you are getting home insurance for your first home where you’d be doing extensive renovation, you may want to consider getting more coverage for renovation. If your home is fitted with mirrors to make it look bigger, then a plan that covers for ‘accidental breakage of mirrors and fixed glass’ (enhanced benefit of Tiq Home Insurance!) would be relevant.

If you are an art or antique collector, you may want to look into a plan that covers your valuables. Knowing your needs will help you to better gauge what coverage you should be looking out for. Wondering what questions to ask before getting your home insurance? Read this!

2. Know your budget

Buying a house is a huge commitment that goes beyond making the deposit payment. There are various miscellaneous costs to consider, and here’s where you need to prioritise your money. The minor but essential expense for home insurance could save you from incurring substantial costs in the event something goes wrong.

To calculate how much you need to insure your home for, you must first know the rebuilding costs of your home. You can get an estimate from your contractor for this.

Besides that, consider what you’d like to insure and for how long. The coverage and tenure will determine the premium. If you have a limited budget, you may want to consider a shorter policy term. However, insurers do offer discounts and incentives for those who purchase a longer term policy, which sometimes can be of better value.

3. Know your options

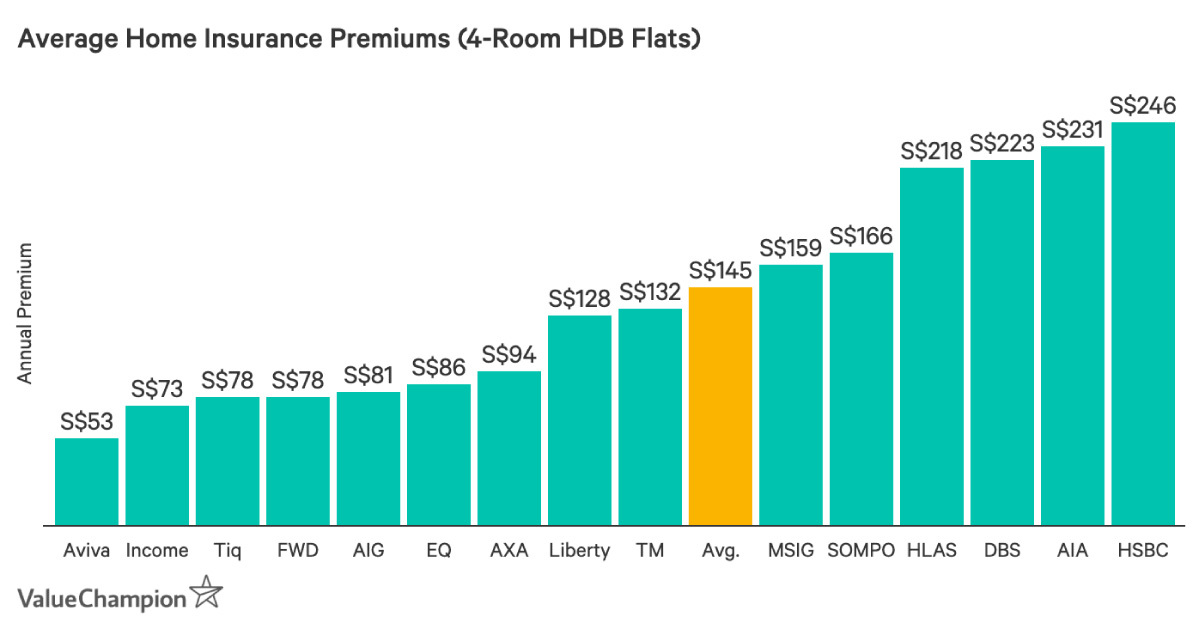

Equivalent to a cheat sheet, insurance aggregator and review sites such as ValueChampion, Seedly and Money Smart help to list the various home protection plans in Singapore. With a listing of what’s available, and the knowledge of what you need and a budget, you will be able to select a suitable home insurance by the elimination theory.

In fact, Tiq Home Insurance is recognised as the best value home insurance for both private properties, HDB flats and even for tenants at ValueChampion. Also, it is the most popular home insurance on Seedly based on real user reviews! Everyone wants to get the best value, but before you go for the cheapest option, consider the following important factors:

- Reputation

To determine the reputation of the insurer, check the credit ratings (usually published on the insurer’s company website) as well as search for customer reviews. You may also want to enquire the opinions of your family and friends who have purchased their home insurance. F.Y.I. Etiqa Insurance has been < target=”_blank”a href=”https://www.fitchratings.com/research/insurance/fitch-affirms-etiqa-entities-ifs-at-a-outlook-stable-06-05-2020″>rated ‘A’ (strong) by Fitch Ratings with a stable outlook consecutively from 2019 to 2022.

- Customer service model

Is it easy to purchase the products and talk to a service staff easily? If you have problems seeking answers prior to your purchase, chances are you may meet greater difficulties in getting a response post-purchase. Also, how simple or convenient is the purchase journey? Is there clear and transparent information on where to proceed after you have gotten your home insurance?

This customer of Tiq Home Insurance shared his experience on Seedly on how he could easily ask questions through our Live Chat function as well as the smooth and easy purchase journey for customers.

- Claims process

This is the reason for your home protection purchase. Ideally, the claim process should be fast and easy. Speak to a customer service officer or get the information online on the claims procedure prior to your purchase. Make a comparison across your shortlisted options. You may also wish to consider checking out claims reviews on forums and social media channels.

You may also like this: Top 5 Home Insurance Mistakes That All HDB Homeowners Should Avoid

TL;DR Which home insurance is best in Singapore?

Everyone wants to find the best deal but it is important to note that the best is not always the cheapest. The best home insurance would of course be the one that suits your needs, budget, and provides you with good, reliable service.

In addition to what we mentioned above, it is crucial to understand what is covered before buying an insurance policy. You can find these in the policy wordings. If you are unsure about the product, feel free to ask. That’s another way for you to determine the service level after all!

Tiq Home Insurance is one of the most affordable home insurance in Singapore. Based on ValueChampion’s analysis, we provide one of the best deals for an average owner-resident in a Singaporean HDB property. For fuss-free home protection to complement your fire insurance, Tiq Home provides flexible coverage on renovation, home contents and building.

In addition, the Emergency Home Assistance (EHA) for electricity, locksmith, pest control and plumbing issues as well as Emergency Cash Allowance of up to S$5,000 if your home is uninhabitable are much-appreciated benefits lauded by our customers. Don’t take our word for it though. You can read real user reviews here and here.

Click here to get a quote on Tiq Home Insurance now!

[End]

Information is accurate as at 19 September 2024.

The information and descriptions on this website are provided solely for general informational purposes and do not constitute any financial advice. It does not have regard to the specific investment objectives, financial situation and particular needs of any persons.

This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Protected up to specified limits by SDIC.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.