We often hear people saying, “don’t put all your eggs in one basket”. This applies to various aspects of life, including how you manage your money. When investing, diversification lowers your risk, smooths out returns, and can improve your portfolio performance in the long term. So, why not?

While the idea of spreading your money across and within different asset classes such as stocks, bonds and cash can sound intimidating, you can easily diversify with a right investment tool such as Tiq Invest. Let us show you how.

Diversification Strategy #1: Have a back-up plan

The entire idea of diversifying your portfolio is to reduce risk, so you have a better chance of improving your portfolio performance. That’s why you should always have a back-up plan. Before you think that this sounds tough, it’s actually just ensuring that you have sufficient cash or savings in case you encounter unexpected costs along the way.

This strengthens your holding power, so you don’t panic sell during stock market dips, especially if you are in the early years of your investments. As you know, long term investments can help you to reduce costs and earn compound interest, which can contribute to better long-term returns.

On the other hand, imagine someone who does not have sufficient cash yet s/he is laden with existing debts amidst the global downturn, rising inflation and interest rate. Sounds like a nightmare, right? Besides the stress and anxiety, s/he may not have a choice but to sell his/her stocks.

Hence, a good starting point on your investment journey would be to have an emergency savings fund that’s equivalent to 6 months of your daily expenses. That’s even if you have a stable job.

Diversification Strategy #2: Spread your wealth

Say, you would soon reach the first milestone of your savings goal at S$100,000. What would you do with S$100,000? From savings accounts to purchasing mutual funds and equities, there are many financial tools with different purposes and risks to help you manage your money.

Here’s when you have to keep in mind rule #1 of diversification: have sufficient cash. Once you’ve set aside enough accessible savings, you can consider investing across different assets to spread your risk. Think Tiq Invest.

Tiq Invest is a flexible digital Investment-Linked Plan (ILP) that covers both investment and life protection, and S$1,000 is all you need to start your investment journey.

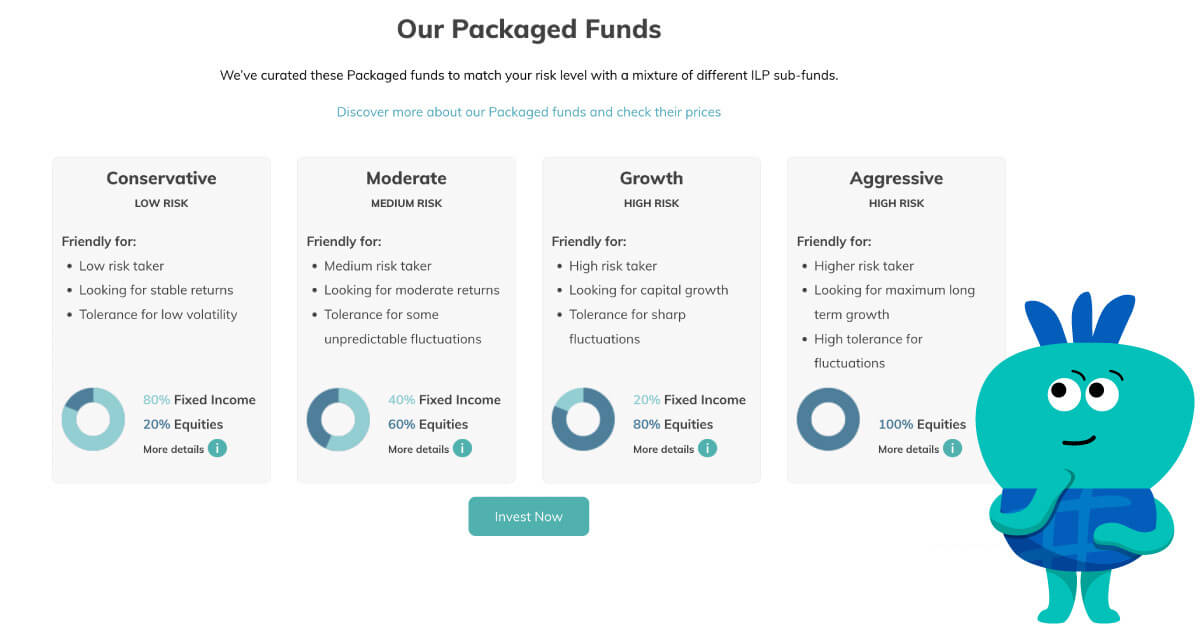

This flexible investment product makes diversifying your portfolio easy because it offers four packaged funds with varying risks and potential growth, so you can simply tap on opportunities with a mixture of asset classes (fixed income & equities) designed to maximise returns at your comfortable risk level.

Managed by professional fund managers with local expertise, Tiq Invest empowers and encourages investors to manage their investments on the Tiq by Etiqa mobile app, so you can view and make transactions conveniently anytime, anywhere.

Protection is just as important as wealth accumulation. With Tiq Invest, you’re safeguarded at 105% of your net premium1, regardless of how your investment performs. This complimentary life coverage ensures that if the unexpected happens, your beneficiaries—typically your loved ones—will receive financial support. Consider it an extra safety net as you diversify your portfolio. Learn more.

Diversification Strategy #3: Keep building your portfolio

After you diversify your portfolio with Tiq Invest, don’t stop there! Keep building your portfolio by applying investment strategies such as dollar-cost averaging (DCA) to further spread out your risks.

Instead of buying the dip with lump sum investing, keep in mind that consistency – the key to DCA – allows you to divide the total sum to be invested across periodic purchases of a target asset and this shall reduce the impact of volatility on your overall purchase.

Simply put, all you need to do is to invest a fixed sum of money into a particular investment at regular intervals, typically monthly or quarterly. With Tiq Invest, you can easily apply DCA by opting into the automated recurring top-up with preset features according to your preference, i.e. monthly, quarterly, semi-annual or annual from S$100.

You may also like:

- Things to Know about Dollar-Cost Averaging and Lump Sum Investing

- How to Purchase Tiq Invest Digital ILP?

Diversification Strategy #4: Review your investments regularly

A survey by Select and Dynata found that almost half (49%) of investors check their investments’ performance at least once a day or more, which makes investors susceptible to myopic loss aversion; aka the more you monitor your portfolio, the riskier you’d perceive investing to be, and you’d become more sensitive to loses than to gains. This inevitably leads one to impulsive investment decisions that can hinder portfolio growth.

While we recommend you to review your investments regularly, don’t monitor that frequently. F.Y.I. There’s periodic rebalancing for Tiq Invest to ensure investors’ objectives are on track and tolerant to market outlook.

You may want to check your portfolio monthly or every two to three months. At the minimum, make it a point to review your investments at least once a year to ensure that your portfolio is performing and still relevant to your financial goals.

As its tagline suggests, Tiq Invest is designed for maximum financial flexibility. Contrary to myths about ILPs, our digital ILP does not have a lock-in period. This means that you have access to cash anytime, anywhere, whenever you need it – free of charge2. Also, you can switch your Packaged Funds at no additional charge so it stays relevant to your investment objectives.

What happens if you over-diversify your portfolio?

“Too much of something is bad enough… …”

The harmonious vocals of the Spice Girls came to mind as we pondered on the effects of over-diversification. In the course of investing, over-diversification can sneak up on you unknowingly. When you take a little of this and that, overlapping may occur and this increases your risks, transaction costs, etc.

Well, the good news is this is almost unlikely to happen with Tiq Invest since you can only choose one of the four Packaged Funds at any one time. As mentioned previously, these mixtures of asset classes (fixed income & equities) in our digital ILP are specially curated by experienced professionals.

“Too much of nothing is just as tough … …”

As increasing prices start to put a strain on our finances, it’s time to consider how you can diversify and make the most of your spare cash to accumulate your wealth, or at the very least, preserve the value of your hard earned money.

Learn more about Tiq Invest and start your investment journey today!

[End]

1 Refers to single premium plus ad-hoc and recurring top-up paid to date less withdrawals less any fees and charges applicable.

2 The minimum partial withdrawal amount is S$200. After partial withdrawal, the minimum account balance must be at least S$200.

Information is accurate as at 30 October 2024. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

Tiq Invest is an Investment-linked Plan (ILP), which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via www.tiq.com.sg/product/tiqinvest. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.