Unlike traditional investing, goal based investing and Tiq Invest Investment-Linked Plan (ILP) focus on how you are able to meet your life goals rather than obtaining high portfolio returns.

Have you ever wondered why Singaporeans work so hard? In 2020, a Kisi survey revealed Singapore as the second most overworked city amongst 50 cities around the world. Perhaps you are also caught in this rat race; doing your best to fund your dream wedding, first home or even your child’s higher education expenses. This is where goal based investing comes into place.

What is goal based investing?

Before you jump on the bandwagon of investing just because everyone else seems to be doing so, stop. Think about why you are investing and your answer should be more in-depth than just ‘earning more money’.

Goal based investing is a practical approach that measures your investment performance based on the progress towards your long term goals rather than on annual percentage returns. This investment strategy aligns investing with the objective of attaining specific life goals, thereby setting perimeters and discipline to your investing method rather than timing the market to boost portfolio returns.

For example, if your main investment goal is to fund your child’s education, you would most likely adopt a more aggressive investment strategy as compared to if your goal is to save for retirement. Beyond the time frame and funds needed, you will also need to consider your age, resources, expenses, risk appetite, etc.

Goal based investing is made easier with Tiq Invest, a digital ILP that combines life protection and wealth accumulation. It offers four specially curated Packaged Funds (a mixture of fixed income funds and equities) to match your risk level while maximising returns. Learn more.

Benefits of goal based investing

- More rational and strategic investing; lower risks

While all investments come with risk, it is possible to minimise risk but it certainly is not done by timing the market. Buying low and selling high often induces one to invest based on emotions, leading to greater risks.

On the other hand, goal based investing requires prior consideration and planning, which provides clarity for investors to be more strategic and disciplined. With focus on your ‘end’ goals, investing is made less emotional and more rational – so you reduce chances of making impulsive decisions and overreacting during market fluctuations, thereby reducing investment risks.

- Greater motivation to perform better

When you have a well-defined life goal, you are more invested than ever, and that increases motivation to ensure your investments are on the right track. Based on a 2020 McKinsey study, investors with a clear and inspiring mission to guide their decisions are more likely to outperform their peers.

Ever heard of the term “investment policy statement (IPS)”? That’s how investors usually express their mission and ensure that decisions are made with it in mind. Your goals can help you to stay the course and keep you disciplined as you measure and track your progress periodically. This will help you to strategise and deal with market fluctuations in a better way, and for a longer term..

- Investments made easier with intentionality

New investors often ask, “how much should I invest?”, “what is the risk in investing,” “where or when to start investing”, etc. With goal based investing, you will get the answers to these common questions.

For example, if you are working towards funding your first Build-to-Order (BTO) home, you’d have to consider the price, potential loan and loan period, interest rate, etc. Having these figures will give you an idea of the ideal investment returns required to meet this life goal. Taking into consideration your age and income capability as well as other commitments, you will know how much and what funds to invest. With intentionality, investments are made easier.

Pro-tip: Tiq Invest digital ILP can make investing easier for you too! In fact, you can start investing in just 4 steps. Learn more now.

Planning your financial goals with Tiq Invest

There are various financial tools and avenues for investments that you could choose based on your risk appetite and expected returns. Tiq Invest digital ILP makes it easy for investors to start investing from just S$1,000, and with one of the lowest charge fees1 at 0.75% per annum of your account value.

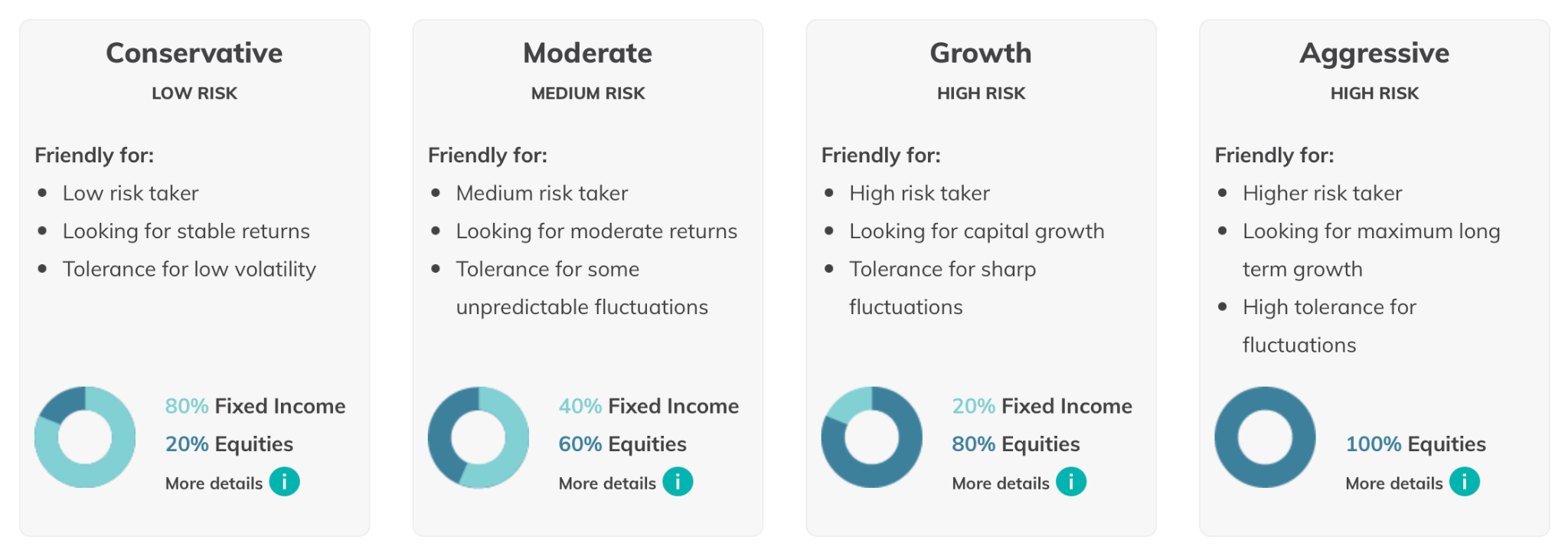

Sounds appealing? Let’s get back to how you can complement goal based investing with Tiq Invest. Depending on your financial goal, investment time horizon and risk preference, you can choose from one of these four packaged funds.

- Conservative (low risk level)

- Moderate (medium risk level)

- Growth (high risk level)

- Aggressive (high risk level)

If you are investing for short-term goals (usually about 2 to 3 years) such as a round-the-world trip, MBA course or a dream wedding, you may want to consider an investment option that ensures the safety of your invested capital. To lower investing risks, consider applying the dollar-cost averaging strategy by opting for Tiq Invest’s recurring top-up feature where you can automate your investment on a regular basis, i.e. monthly, quarterly, semi-annual or annual from S$100.

Medium-term goals are those that can be achieved over 3 to 8 years, and due to the wider time horizon, it provides investors with greater flexibility and investment options. If you are investing for a medium-term goal and are comfortable with taking on more risks, you may consider the Growth or Aggressive Packaged Funds.

Time – not timing – is crucial when it comes to investing. Hence, it benefits to start investing early. For those investing for long-term goals such as financing a house or building a retirement nest (usually takes about 8 to 10 years or more), it means that you have a longer time frame to earn compound interests while riding out market fluctuations (lowering risks). Hence, you can consider any of the Packaged Funds according to your risk appetite.

Pro-tip: With Tiq Invest, 100% of the single premium paid and all top-ups will be invested into your selected packaged fund, according to the sub-funds allocations – unlike some traditional ILPs. This means 105% guaranteed insurance protection2 – a backup plan for your loved ones in case of unfortunate events such as death – is complimentary!

Start goal based investing with Tiq Invest

Many of us are used to putting our money in various forms of financial tools such as fixed deposits, endowment plans, shares, real estates, etc. However, if these are not linked to any specific goals, they are random savings or investments with no specific duration to invest or to expect returns.

Such randomness presents an opportunity cost – the cost to achieve your personal goal(s) effectively.

Goal-based investment promotes intentionality so that you can construct your portfolio based on whether your assets and the way they are combined will meet their ultimate objectives. It can help you to achieve wider clarity over your planning and execution, discipline you about saving and investing and facilitate you in achieving more with smaller investments.

[End]

1 Based on the available digital Investment-Linked Plan (ILP) as at 12 July 2024. This comparison does not include information on all similar products. Etiqa Insurance Pte Ltd does not guarantee that all aspects of the products have been illustrated. You may wish to conduct your own comparison for products that are listed in www.comparefirst.sg.

2 Refers to single premium plus ad-hoc and recurring top-up paid to date less withdrawals less any fees and charges applicable.

Information is accurate as at 12 July 2024. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

Tiq Invest is an Investment-linked Plan (ILP), which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via www.tiq.com.sg/product/tiqinvest. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.