Having a baby in Singapore may seem like a scary notion with hormone changes and hefty fees tagged to pregnancy, delivery and the costs of raising a child in one of the world’s most expensive cities. This is more so in the current pandemic crisis.

But there are perks to having a child that you can call your own, and there is support from the government to help parents to defray the initial costs. So keep calm and read on to learn more about Child Development Co-Savings (Baby Bonus) Scheme, freebies and savings tips in Singapore.

Baby Bonus Cash Gift and (new!) Baby Support Grant

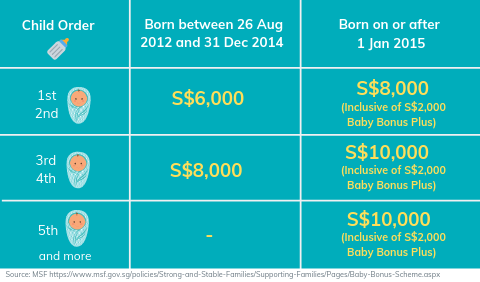

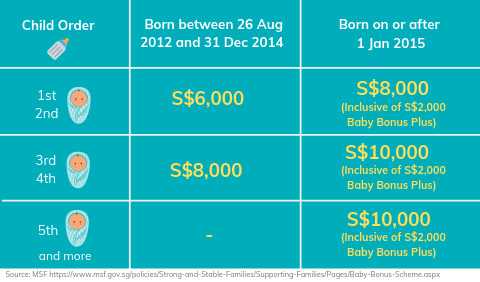

Around the world, baby bonus are offered by governments to assist local parents with the financial costs of raising children. In Singapore, parents can also look forward to a baby bonus cash gift if your child is eligible! This Ang Bao^ will be given in 5 instalments, over 18 months.

Your child is eligible for the baby bonus cash gift if he/she meets the following criteria:

- Born on or after 1 January 2015, or has an estimated date of delivery on or after 1 January 2015;

- Singapore Citizen or becomes a Singapore Citizen; and

- The child’s parents are lawfully married.

Wait! That’s not all! On top of the Baby Bonus Cash Gift, a one-off grant of S$3,000 will be given to parents of infants born from Oct 1, 2020 to Sep 30, 2022. This Baby Support Grant is offered by the Singapore Government in view of the COVID-19 pandemic.

How to apply for Baby Bonus Cash Gift and Baby Support Grant?

Eligible parents can visit https://www.babybonus.msf.gov.sg to learn more and apply to join the Baby Bonus Scheme.

^Ang Bao is a red envelope (generally containing money) that is given as a gift.

Child Development Account

The importance of saving can be cultivated young with the Child Development Account (CDA), a special savings account for children.

With the CDA First Step grant, parents will automatically receive S$3,000 in their child’s CDA. Parents are not required to first save into the account. This fund can be used for the healthcare and educational needs of a child and/or his siblings.

Beyond this grant, parents who save into the CDA will continue to receive dollar-for-dollar matching from the Government, and the total Government contributions will be up to the existing contribution cap shown below. This means that if you save S$3,000 into the CDA for your first child, the government will contribute S$3,000 to match. You will be required to select a bank to open this account.

You may also like: Should I have a child in a pandemic? Read now!

Medisave Grant

If your baby is born as a Singapore citizen, he/she will get a Medisave grant of S$4,000 in a Medisave account that’s automatically created in his/her name upon registration of birth. Ain’t that awesome? This grant can be used to cover the costs of your child’s healthcare expenses such as recommended childhood vaccinations (remember BCG?), MediShield Life premiums and approved outpatient treatments.

Personal Income Tax Relief and Rebate

Guess what? Having a child also entitle you to claim for tax relief and tax rebate if you are already paying income tax. This means greater savings for parents! Check out these four tax relief and rebate that every Singaporean parent should know!

- Qualifying Child Relief (QCR) – A tax relief of up to S$4,000 per child to be shared between working spouses.

- Handicapped Child Relief (HCR) – A tax relief of up to S$7,500 per child to be shared between working spouses. However, one can only claim for either the QCR or HCR.

- Working Mother’s Child Relief (WMCR) – If you are a working mother, you can claim the WMCR at 15% of your earned income for your 1st child, 20% for the 2nd, and 25% per child for all subsequent children, with a maximum cap at 100% of your earned income.

- Parenthood Tax Rebate (PTR) – Given to parents who are paying income tax, this is a tax rebate based on the income tax that one is liable to pay. Eligible parents can claim PTR of $5,000 for their 1st child, $10,000 for the 2nd child, and $20,000 for the 3rd and each subsequent child. Spouses will share the PTR based on an apportionment agreed by the couple.Note that this differs from the tax relief that only reduces a person assessable income. Any unutilised amount of PTR will be carried forward to offset against the income tax payable for subsequent years, until the rebate has been fully utilised.

Parenthood Paid Leave

Maternity Leave

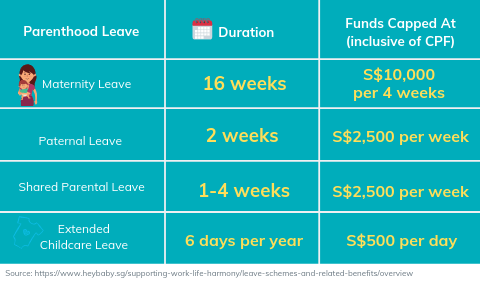

Parenthood Leave allows working parents to spend more time with their newborn! To begin with, working mothers get 16 weeks of paid Maternity Leave, which can be taken continuously as a block starting from up to 4 weeks before the date of delivery. The last 8 weeks of leave can also be taken flexibly over a period of 12 months from the birth of your baby upon mutual agreement between the employer and employee.

Paternity Leave

Working fathers can get 2 weeks of paid Paternity Leave, which can be taken continuously as a 2-week block within 16 weeks after the birth of your child, or flexibly within 12 months after your baby is delivered as long as there is mutual agreement between the employer and employee.

Shared Parental Leave

There’s also an option for working fathers to share a portion of their wives’ 16 weeks of Maternity Leave. For parents of children born on or after 1 July 2017, working fathers are eligible to share up to 4 weeks of their wives’ Maternity Leave as long as the latter agree.

Extended Child Care Leave

Juggling between work and taking care of your family requires you to strike a balance and an extra 6 days of paid Child Care Leave every year for working parents with at least 1 Singaporean child under the age of 7 years is pretty awesome!

To check your eligibility for these parenthood leave, visit https://www.heybaby.sg.

Freebies

Parents-to-be and new parents can also enjoy free diapers, milk powder samples and complimentary pregnancy gift packs that will save you a neat sum! In addition to the savings, it is practical to try out the different brands of diapers and milk powder to find the ones that suit your baby best! Some freebies to keep in mind include Cetaphil’s baby wash and lotion samples, Mighty Pack from Mighty Sprouts, and Cradle of Love’s Baby Gift which includes a maternity photoshoot, a baby photoshoot or a baby carrier worth S$199!

Also, don’t miss out on baby fairs for good deals. Seasoned parents know the perks of buying in bulk, especially if the little one is going through ‘the milk monster stage’.

P for Priority

In most cases, the pregnant lady gets priority; seat on the MRT, choice of food, express access at certain venues, etc. Being a parent certainly has its perks in spite of the high costs of raising a child in Singapore. From pregnancy to delivering a baby, the cost ranges between S$5,000 to S$15,000. Parent can easily incur between S$8,000 to S$18,000 in the first year of raising their baby. As such, parents need to get their priority right. In addition to keeping physical and emotional health in check, it is important to plan and save for expenses.

Think Long-Term

In addition to the abovementioned grants, parents can reduce expenses by adopting a simpler lifestyle, and share saving tips and resources (e.g. pre-loved items such as clothing and toys) with family and friends. It will be worthwhile to consider a long-term perspective when it comes to making financial decisions so as to ensure that you have easy access to your funds during times of need.

#TiqOurWord GIGANTIQ is an all-in-one insurance plan that offers flexible insurance savings and protection solutions. With attractive interest rate and no lock-in period, you can start saving with just S$50. Learn more here

Becoming Parents

“You know what the great thing about babies is? They are like little bundles of hope. Like the future in a basket.” -Lish McBride

In Singapore, we often hear our fellow citizens lamenting on the costs of having a baby and how it takes plenty of courage, money and effort to expand the family. With the government’s support for parents adding up to S$50K+ (based on the abovementioned), it does take some financial pressure off the family.

So why not put aside some cash to grow your wealth for when the baby is here? Besides GIGANTIQ, our EASY save series insurance savings plan offers short to longer term options with attractive returns of up to 4.07% p.a. (terms apply). You also get life protection and Financial Assistance Benefit for Novel Coronavirus (COVID-19), so you’ll be prepared no matter what the future brings.

Intangible Benefits

Beyond that, the best perks of having a baby are intangible. This little one will share important moments in your life, and both parents and child will learn valuable lessons and grow together. Yes, it is challenging but this can also bring you the greatest satisfaction in life.

[End]

Information is accurate as at 3 November 2020. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Protected up to specified limits by SDIC.

GIGANTIQ is not a bank account or a fixed deposit. It is an insurance savings plan that earns a crediting interest rate.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.