There’s a margin of risk to everything that we do, including investment, but as investment guru Warren Buffett said, “risk comes from not knowing what you are doing.” Understanding the different types of investment risk and the risk-return trade-off will help you to decide how much risk you are willing to accept for your desired return. Read on to learn what exactly investment risk is and how much you can really afford to invest.

What is investment risk?

Be it to accumulate wealth or hedge against inflation, people typically invest with the intention to earn returns and make the most of their money. However, all investments carry some degree of risks. Investment risk refers to any uncertain situations or factors that may adversely affect your investment returns and financial health; in simpler terms: losing money.

Can you afford to hold on to your investments when it is not performing well? Do you have sufficient funds to weather through market fluctuations? This depends on your risk tolerance. Don’t mistake it with your risk appetite – which is essentially how much risk you are willing to take in order to achieve your investment objectives.

The investment risk and return are important factors that can help you to decide on what and how much you should invest. As shown in the above risk-return trade-off chart, low levels of risk are typically associated with lower potential returns whereas the higher levels of risks are associated with high potential returns.

Just like the choices of amusement park rides; some people prefer the carousel, which is relatively more stable and safer than the thrill-seeking roller coaster. If one chooses the carousel ride, s/he is likely to miss the adrenaline rush and greater excitement (return) promised by the roller coaster.

Nonetheless, let’s keep in mind that theme park visitors have different profiles with varying risk appetite and tolerance. Taking the roller coaster does not automatically ensure that one will get a natural high. Similarly for investors, higher risk does not guarantee higher returns.

So how much should you risk on investment?

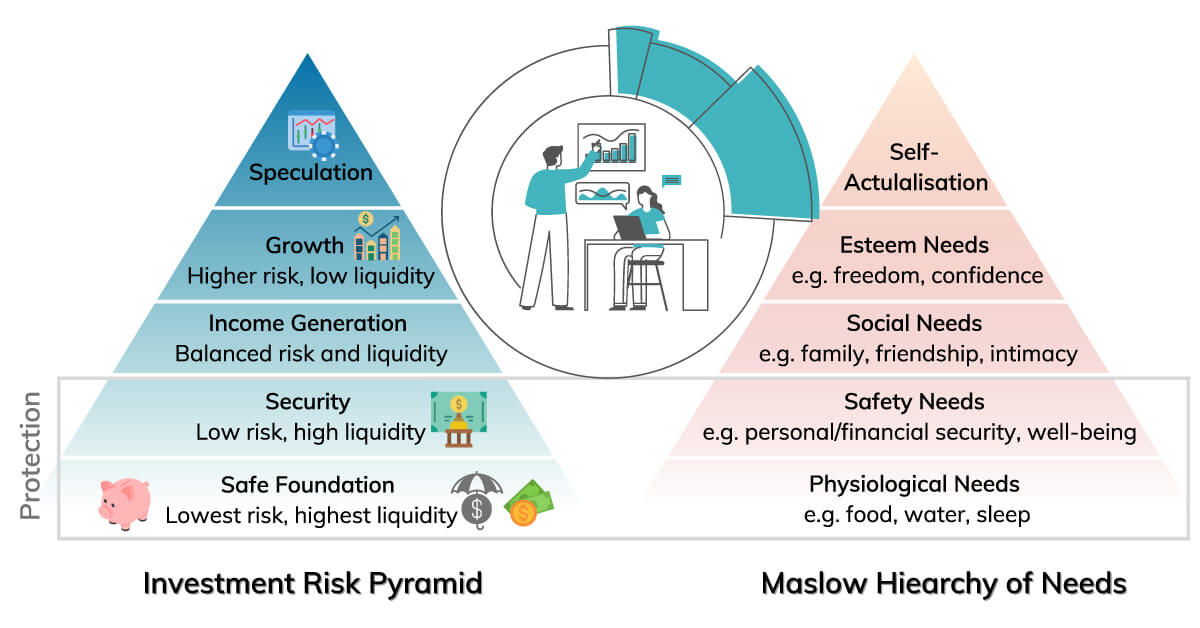

Before you start your investment journey or if you are feeling unsure about your current investments, always fall back to basics and refer to the investment risk pyramid. [See above chart]

The investment risk pyramid – an asset allocation tool – can give context to general risk and potential returns associated with different investments, and help you to better identify the types of investment that better fit your risk tolerance. Just like Maslow’s hierarchy of needs, the investment risk pyramid should be considered from bottom-up.

Lowest tier of investment risk pyramid

At the base of the investment risk pyramid, you will find low-risk assets with high liquidity, which are generally your savings, cash, life insurance, etc. Being at the bottom of the pyramid, they represent a safe foundation for your financial portfolio. This is important as it can affect investor’ confidence and holding power in times of market fluctuations.

Hence, you should always ensure that you have your basic needs covered, which includes having life insurance coverage and setting aside an emergency fund that can sustain at least 3 to 6 months of your daily expenses. Invest only when you have excess funds that you can afford to lose. (More tips on investing)

Middle tier(s) of investment risk pyramid

AAs you move up the tiers on the pyramid, the objectives will shift to growth or wealth building, typically correlating to medium-risk investments that generally offer a stable return and the possibility of capital appreciation; e.g. a good growth stock, real estate, mutual funds, etc.

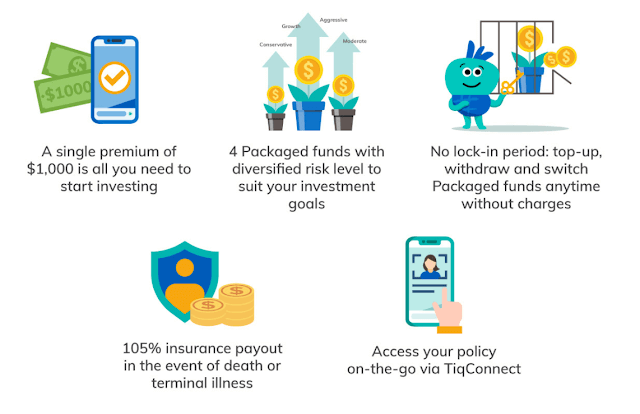

If you are just starting to invest or seeking diversification for your current investment portfolio, you may want to consider Tiq Invest – a digital investment-linked plan (ILP) that combines life protection and wealth accumulation.

This investment tool can add weight to the foundation of your investment risk pyramid while helping you to grow your wealth. Contrary to misconception, you don’t need a lot of money to start investing. With Tiq Invest, you can start investing from S$1,000.

Peak of investment risk pyramid

Speculation, at the peak of the pyramid, refers to high risk investments that offer high potential return. These include stock options, futures, commodities, etc. and are the kind of investments that you should consider only if you can afford to lose them. Never make such high risk investments with money you intend to use in the near future for buying a home or your retirement funds when you’re already retired.

Also, you may have heard of the 5% rule in investing, which is an investment philosophy that focuses on diversification. Generally speaking, a diversified portfolio can help to reduce the volatility (and risk) of your portfolio over time. In the case of the 5% rule, it means that an investor should not allocate more than 5% of their portfolio funds into a security of investment.

Tiq Invest understands the importance of diversification, hence it offers four packaged funds with a mixture of asset classes (fixed income & equities) designed to maximise returns at your comfortable risk level. In addition, there’s no lock-in period, which means investors have access to cash anytime, anywhere, whenever you need it, free of charge1. Learn more here

Take the risk or lose the chance?

The 50/30/20 rule is a popular budgeting strategy amongst Singaporeans but how much to invest and what you invest in actually differs for each individual, with the following main factors to consider:

- Your risk tolerance – how much risk can you afford to take on?

- Your time horizon – when do you need the money?

- Your current life stage – the investment needs of a young graduate vs a retiree differ greatly and that correlates with investment options

Bear in mind that there are 3 potential outcomes when you invest, namely; gains, losses or breakeven. As rising inflation takes a hit on the value of our money, it is time to consider taking some risk to protect your hard earned savings.

For the risk-averse, you may want to consider long term investments, which typically have lower risks as compared to short term investments. Another way is to apply the dollar-cost averaging strategy by investing a fixed sum of money into a particular investment at regular intervals, typically monthly or quarterly. Doing so can help you spread out your risks and ride through volatility.

[End]

1 The minimum partial withdrawal amount is S$200. After partial withdrawal, the minimum account balance must be at least S$200.

Information is accurate as at 12 July 2024. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

Tiq Invest is an Investment-linked Plan (ILP), which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via www.tiq.com.sg/product/tiqinvest. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg). This advertisement has not been reviewed by the Monetary Authority of Singapore.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.